Donating appreciated real estate to Mercatus—either by directly transferring ownership or making the gift via a trust— is a significant gift that can provide helpful tax benefits.

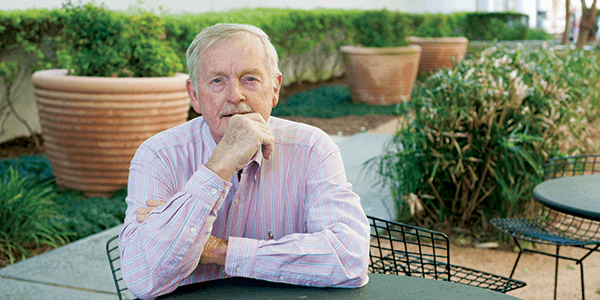

"Although I was an entrepreneur for a little while and made some money at it, I'm certainly not a wealthy philanthropist," says Roger. He and his wife, Judy, have supported Mercatus since 2006. They live in Arizona and have a daughter, two granddaughters, and one great-grandson.

Roger and Judy wanted to make a special gift that wouldn't be possible in any single year. They decided to give a gift of real estate via a charitable remainder trust.

"Everyone's financial situation is different," says Roger. "For those people who are fortunate enough to have assets sufficient so that they can give quite generously while they're still alive—they are going to be in a different situation. For someone like myself and my wife, who do still have a budget, something like a charitable remainder trust is a better way to go."

Planning a gift of real estate allowed Roger and Judy to make a tremendous contribution that fit their lifestyle perfectly.